What Is an Escrow Advance? Traditional & DeFi Explained

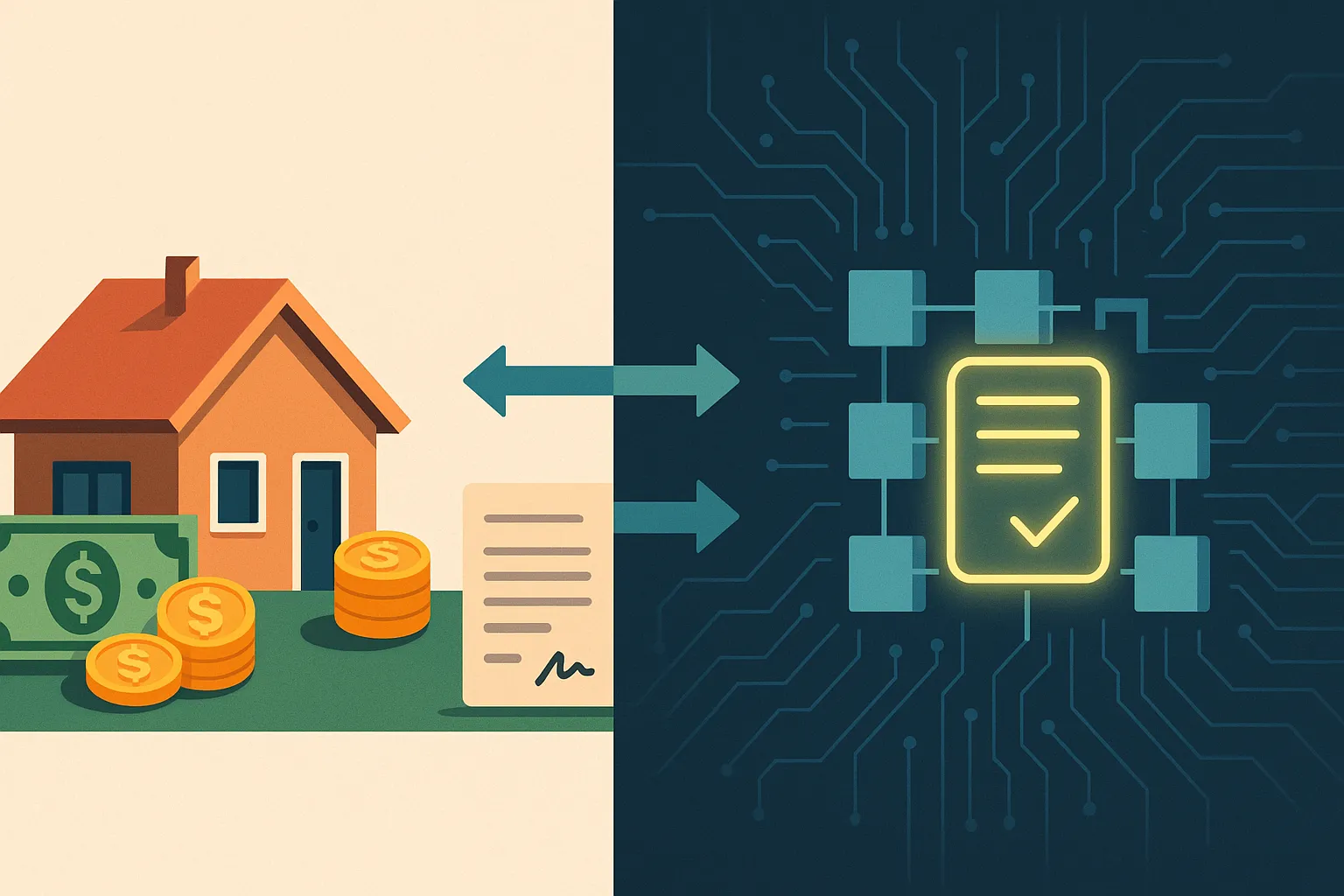

What Is an Escrow Advance? Bridging Traditional Loans and DeFi

An escrow advance bridges the gap when your mortgage escrow account is low—insurance, taxes, or other charges—so you never miss a payment, pay late fees, or receive a policy lapsed. In the blockchain, the same mechanism enables smart contracts to automatically complete collateral or escrowed funds when conditions are not met, combining speed with transparency into what was previously a manual process.

Table of Contents

- Traditional Escrow Advances: A Primer

- How Traditional Escrow Advances Work

- DeFi Escrow Advances: Smart Contracts Take the Stage

- Comparing Traditional and DeFi Approaches

- Real-World Examples and Anecdotes

- Practical Tips for Borrowers and Developers

- Key Takeaways

- Frequently Asked Questions

Traditional Escrow Advances: A Primer

Escrow is when an outside party holds funds until certain conditions are satisfied. In mortgage loans, the lenders create an escrow account to pay your taxes and insurance. When that account is short of funds—common in a refinance or when there has been a rate hike—the lender sends an escrow advance, paying the difference so bills won’t get behind.

This bridge loan is retired in the form of slightly increased monthly payments over time. Although it postpones immediate penalty, borrowers typically observe a slight increase in their home loan payment afterwards.

How Traditional Escrow Advances Work

After closing on a refinance or when your lender reviews your escrow balance, they compare the projected disbursements against what’s in your account. Short on funds? They’ll cover the gap—sometimes thousands of dollars—and then adjust your monthly payment to recoup that advance across the loan term.

To homeowners, it keeps them from paying late fees and losing insurance coverage. To the lender, it is a risk that is factored in when setting reserve requirements and planning future payments

DeFi Escrow Advances: Smart Contracts Take the Stage

Decentralized finance flips this script into code. Your proceeds from sale or crypto collateral are guaranteed by a smart contract and terms monitored by oracles, which are under surveillance by the automated system. In case of a failed trigger or price movement that could leave the escrow in jeopardy, the contract will automatically draw down on a reserve pool to fill the gap.

That is instant action—no manual underwriting or bank transfers. There’s a small protocol fee and blockchain gas, and all advances are on-chain, publicly verifiable.

Comparing Traditional and DeFi Approaches

- Speed: Banks: days; on-chain contracts settle in seconds.

- Transparency: Traditional lenders conceal reserve math; DeFi reveals every advance in the ledger.

- Cost: Mortgage advances are absorbed into your loan; DeFi fees are transparent and predictable.

- Regulation: Mortgages are under CFPB regulation; DeFi exists in regulatory limbo.

By drawing inspiration from both, you can create trust escrow tools that are quick, transparent, and regulatory friendly.

Real-World Examples and Anecdotes

An Ohio homeowner avoided a huge late charge when his property tax increased mid-year; his lender’s escrow advance arrived just in time, although his payment went up by $30 a month until he repaid it. In DeFi, a protocol prevented a cascading liquidation after an oracle failure by automatically topping up collateral, safeguarding users from huge losses.

These stories illustrate how escrow advances act as shock absorbers—so systems stay on line when timing and amounts clash.

Practical Tips for Borrowers and Developers

- Homeowners: Ask your lender to explain in plain language how much you will pay extra and for how long before you commit to an advance.

- Lenders: Investigate more transparent reserve reporting—and possibly pilot smart-contract audits to build borrower confidence.

- DeFi Developers: Close the gap to multi-source oracles and establish fees and triggers clearly, so users have a clear idea of what they are getting themselves into.

Key Takeaways

Dollar or DAI advances on escrow maintain payments on track and shield from penalties. Backward advances supply a proven-tested safety net; DeFi developments supply speed and transparency. Hybridizing the two approaches can give escrow solutions that are at once reliable and innovative.

Frequently Asked Questions

What activates an escrow advance?

In traditional finance, a deficiency in your escrow account—usually revealed in a refinance or a rate hike—activation happens. In DeFi, smart-contract oracles identify collateral declines or price falls and automatically trigger additional funds.

How long does it take to pay back an escrow advance?

Lenders of mortgages will typically stretch out the repayment over your current loan term or restructure your monthly payment for a specific period. In DeFi, repayment is under the protocol terms—typically in the next transaction cycles or through a scheduled top-up.

Do DeFi escrow advances have fees?

Yes. Most protocols charge a traditional protocol fee and normal blockchain gas. There are no surprise margins because these fees are open and written into the contract.

Are escrow advances waivable?

Traditional lenders will provide escrow waivers if you meet on equity or payment performance. In DeFi, you can opt-out of advances by over-collateralizing or bypassing advanced features—although that tends to raise more stringent margin requirements.