Fibonacci Golden Zone in Crypto Trading

Fibonacci Golden Zone for Crypto Trading: A Precise Entry Strategy for Web3 Traders

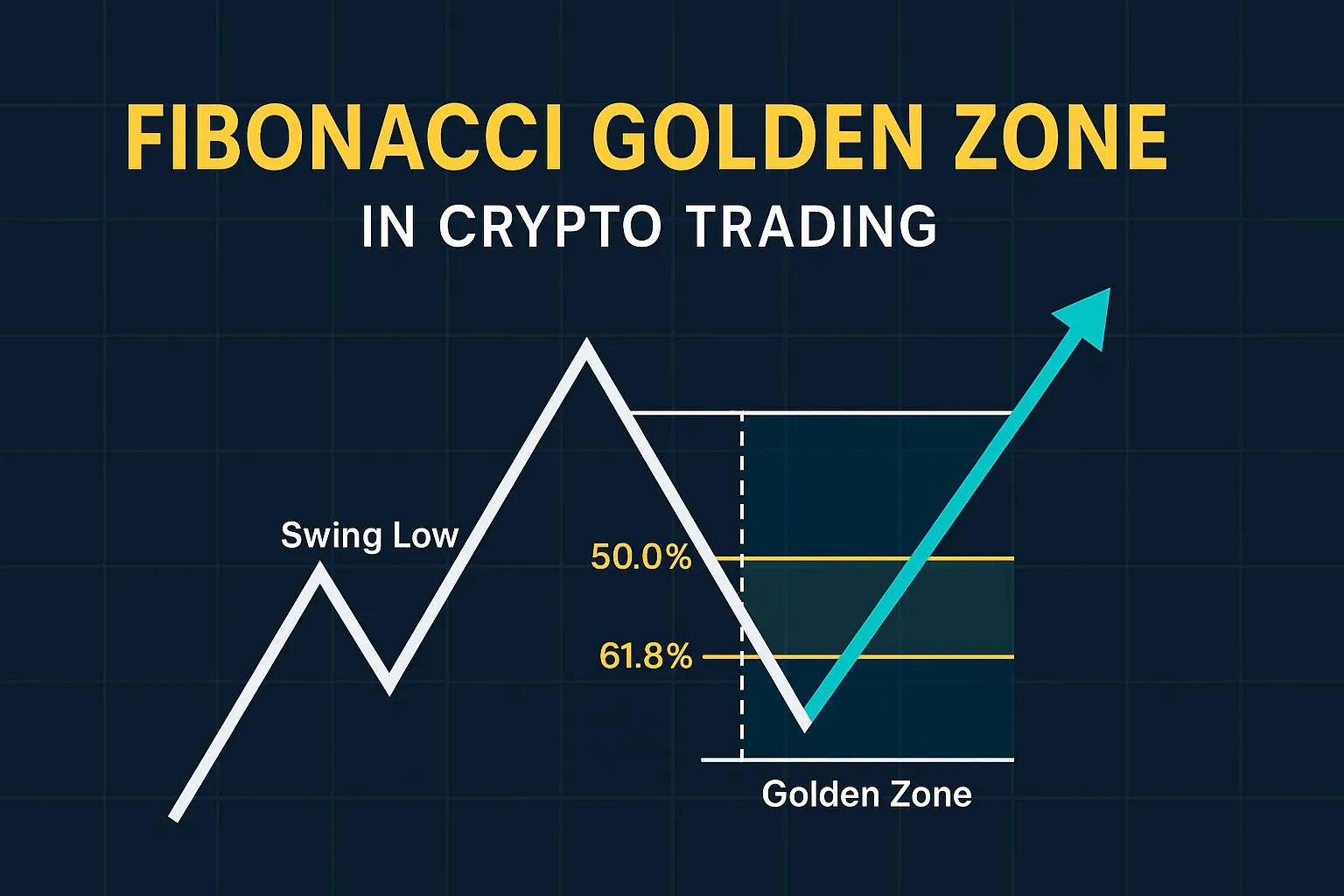

The “Fibonacci Golden Zone” is amongst my favorite tradings, particularly in cryptocurrency and Web3 trading. It indicated towards the zone between the 50% and 61.8% Fibonacci level of retracement. This article will explain how this zone can be utilized for precise entry strategies in crypto markets.

Table of Contents

- Understanding the Golden Zone

- Identifying Swing Points and Drawing Fibonacci Retracement

- Analyzing Price Action within the Golden Zone

- Executing Trades

- Enhancing the Strategy

- In Summary

- FAQ

Understanding the Golden Zone

- Definition: The Golden Zone is between 50% and 61.8% retracement levels on the Fibonacci chart.

- Significance: It’s a high-probability region where price action will reverse or extend in the same direction and thus it is the best region to enter trades.

- Basis: The level of 61.8% is based on the Golden Ratio (approximately 1.618), a mathematical constant that exists in numerous natural phenomena and money markets.

Identifying Swing Points and Drawing Fibonacci Retracement

- Swing Points: first step is to identify clear swing highs and swing lows on your price chart.

- Uptrend: If in an uptrend, apply the Fibonacci retracement tool from the swing low to the swing high.

- Downtrend: If in a downtrend, apply the Fibonacci retracement tool from the swing high to the swing low.

Analyzing Price Action within the Golden Zone

- Reversal Signals: As price is already at the Golden Zone, confirm reversal candlestick formations or any other technological indicators of potential reversal of price.

- Continuation Patterns: Or identify whether price remains to show evidence of continuing the original trend to have already gotten to the zone.

- Confluence: Validate firm analysis by invoking the application of Fibonacci retracement as well as the application of other technological methods such as trendlines, levels of support/resistance, and also indicators for confirmation of any potential signals.

Executing Trades

- Entry: Go long when price action confirms a reversal or continuation pattern within the Golden Zone.

- Stop-Loss: In order to risk manage correctly, place your stop-loss a little beyond the boundary of the Golden Zone.

- Take-Profit: Use Fibonacci extensions to find your exit stops or look for important support and resistance levels.

Enhancing the Strategy

- Confirmation: Apply tools like the Relative Strength Index (RSI), volume, or moving averages in an attempt to validate your trade signals.

- Market Awareness: Keep in mind relevant fundamental news or events that have the potential to significantly impact price action.

- Discipline: Exhibit discipline towards a well-structured trading plan with strict risk management guidelines.

In Summary

The Fibonacci Golden Zone is a great way through which cryptocurrency traders may determine high-probability entry points. Coupled with sound technical analysis and sound risk management practices, it’s a good addition to a successful trading system. Don’t forget that no system is foolproof, though. Be disciplined and prepared to adapt to changing market trends.

FAQ

What is the Fibonacci Golden Zone?

It’s at the 50% to 61.8% region of a Fibonacci retracement. It’s a region that has a tendency to be a good support or resistance level where price tends to react.

What makes the 61.8% level important in crypto trading?

The 61.8% is derived from the Golden Ratio (1.618), which was found to have forecasting qualities in nature systems and the stock market. It’s commonly applied in crypto to forecast possible retracement action.

Is the Fibonacci Golden Zone technique valid in volatile markets?

It can function in the wild crypto markets but needs to be combined with other tools like volume analysis, RSI, and market structure analysis to help weed out probable false signals.

Can I apply Fibonacci on all timeframes?

Yes, you can apply Fibonacci tools on all timeframes. But the quality of the signals will vary, with higher timeframes providing better signals for position or swing trading.

Must I sell at each Golden Zone price touch?

No. Always wait for confirmation in the form of price action, indicator signal, or some other type of confluence before entering a trade.