BOS in Trading: Break of Structure for Crypto Traders

BOS in Trading: How Smart Money Detects Structure Breaks in Crypto Charts

When you’re swimming in Bitcoin, altcoins, and meme coins, knowing where the price actually goes can make all the difference. That’s where BOS — of Structure — enters. If youunderstand Smart Money Concepts (SMC), you willrecognize that BOS is not a word; it ‘sanimportantsign that informs you who ‘sreally driving themarket — thesmart money or retail traders.

Let’s’decipher what BOS means among crypto traders, how to identify it, and why comprehending this phenomenon can totally flip your chart reading.

📘 Table of Contents

- What Is BOS in Trading?

- BOS vs CHoCH: Know the Difference

- How Smart Money Uses BOS in Crypto Markets

- Identifying BOS on TradingView (BTC/ETH Examples)

- BOS + FVG: A High-Probability Combo

- FAQ

- Final Thoughts

1. What Is BOS in Trading?

Break of Structure (BOS) is when price breaks through a previous market level—typically a swing high or swing low—with conviction, marking a change of control in the market. With SMC, BOS typically indicates that institutional traders are on move.

In crypto markets, BOS usually observed in trending phases. For instance, if ETH makes lower highs and lower lows, if price breaksabove the recent lower high quickly with conviction, that’s your BOS. It indicates a change ofstructure, bias shift , and typicallya liquidity sweep. The market algorithm then focuseson new levels.

Key Point:There must be intentionality for a genuine BOS.intentionality.Do not have false breaks or equal highs; instead, wait for confirmation and imbalance.

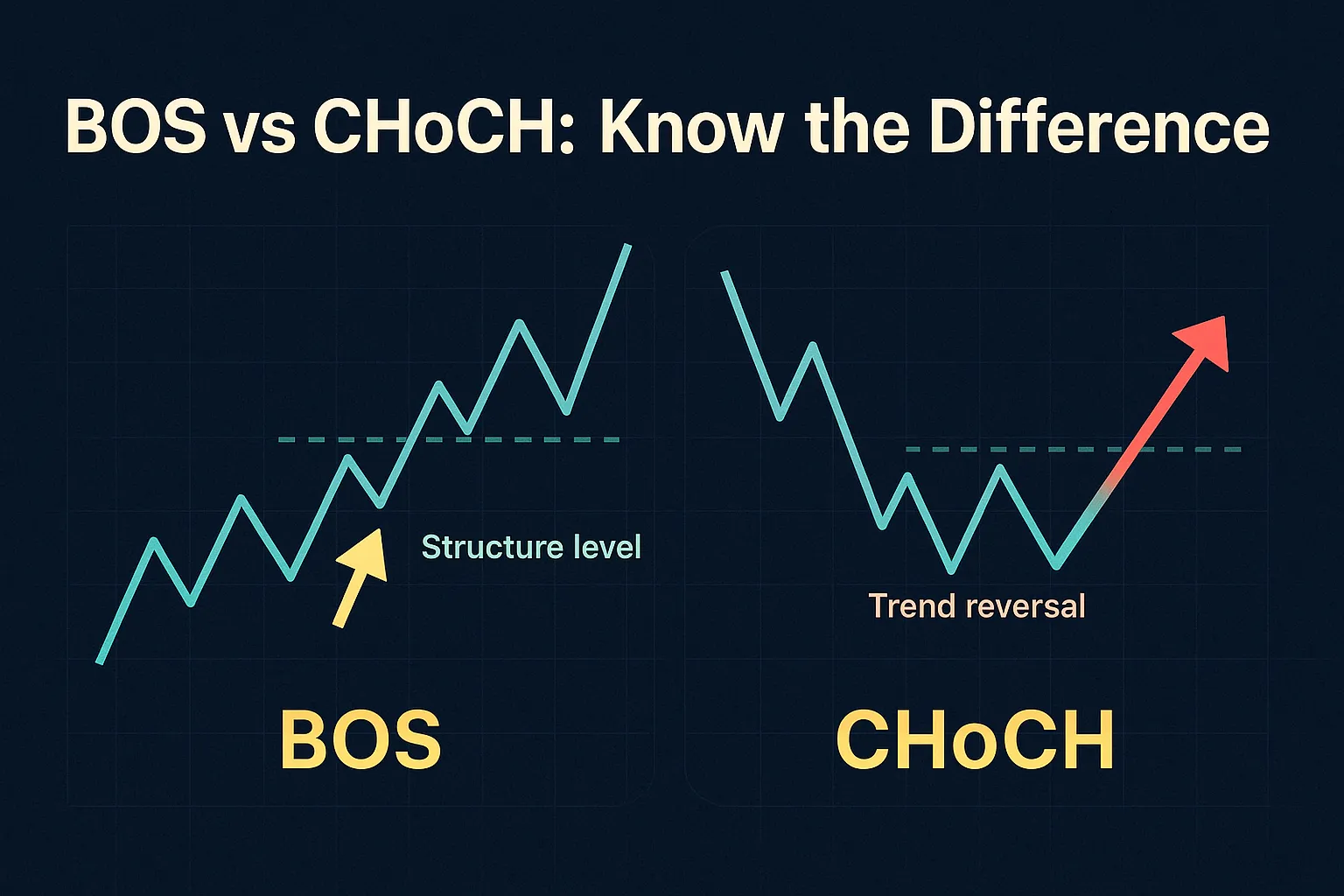

2. BOS vs CHoCH: Know the Difference

Many traders confuse BOS and CHoCH (Change of Character) but they play different roles:

- BOS = Trend continuation. The market was trending, and it continues since it breaks a structure level.

- CHoCH = Trend reversal. It signals a shift from bear to bull or vice versa.

Example:

- BOS: BTC creates a recent swing high in the context of an uptrend and signals continuation.

- CHoCH: SOL breaks the most recent lower high during a downtrend. Potential reversal.

This subtlety is most critical to crypto scalping and swing trading.

3. How Smart Money Uses BOS in Crypto Markets

Smart money — whales, market makers, and institutions — prefer to play BOS on retail traders for their benefit. Their standard game is to:

- Buildup and consolidation of liquidity at even highs. (liquidity).

- A false breakout to attract retail traders.

- A turn reverses, breaking the previous structure level— that’s your BOS.

- Institutions have successfully flipped the market on its head without most traders even knowing it.

In DeFi tokens and low-cap alts, BOS tends to lag liquidity grabs and precedes large impulsive moves, especially in volatile times such as post-FOMC releases or Ethereum hard forks.

Pro tip: Pro Tip: Identifying a BOS right after an imbalance (like a Fair Value Gap, FVG) could mean institutional entry points. Use this as confluence for trades.

4. Identifying BOS on TradingView (BTC/ETH Examples)

Find BOS on TradingView by using structure mapping in combination with reaction zones:

- Look for impulsive, conclusive breaks—not gradual grinding moves.

- Look for Fair Value Gap formation close to the break.

- Highlight significant swing highs and lows.

- Watch volume spikes and displacement candles.

Sample Setup:

-

- ETH/USD 1-hour chart

- Swing high at $3,270 recently

- Price breaks up on a displacement candle to $3,350

- Small FVG formed below

This is a BOS setup. Wait for a retracement into the FVG and then await a long if other confluences are in place.

There are also BOS indicators on TradingView. Some good ones:

- “Smart Money Concepts” by LuxAlgo

- BOS + CHoCH indicator by barrycoder

- ICT-style tools tagging order blocks and zones of liquidity

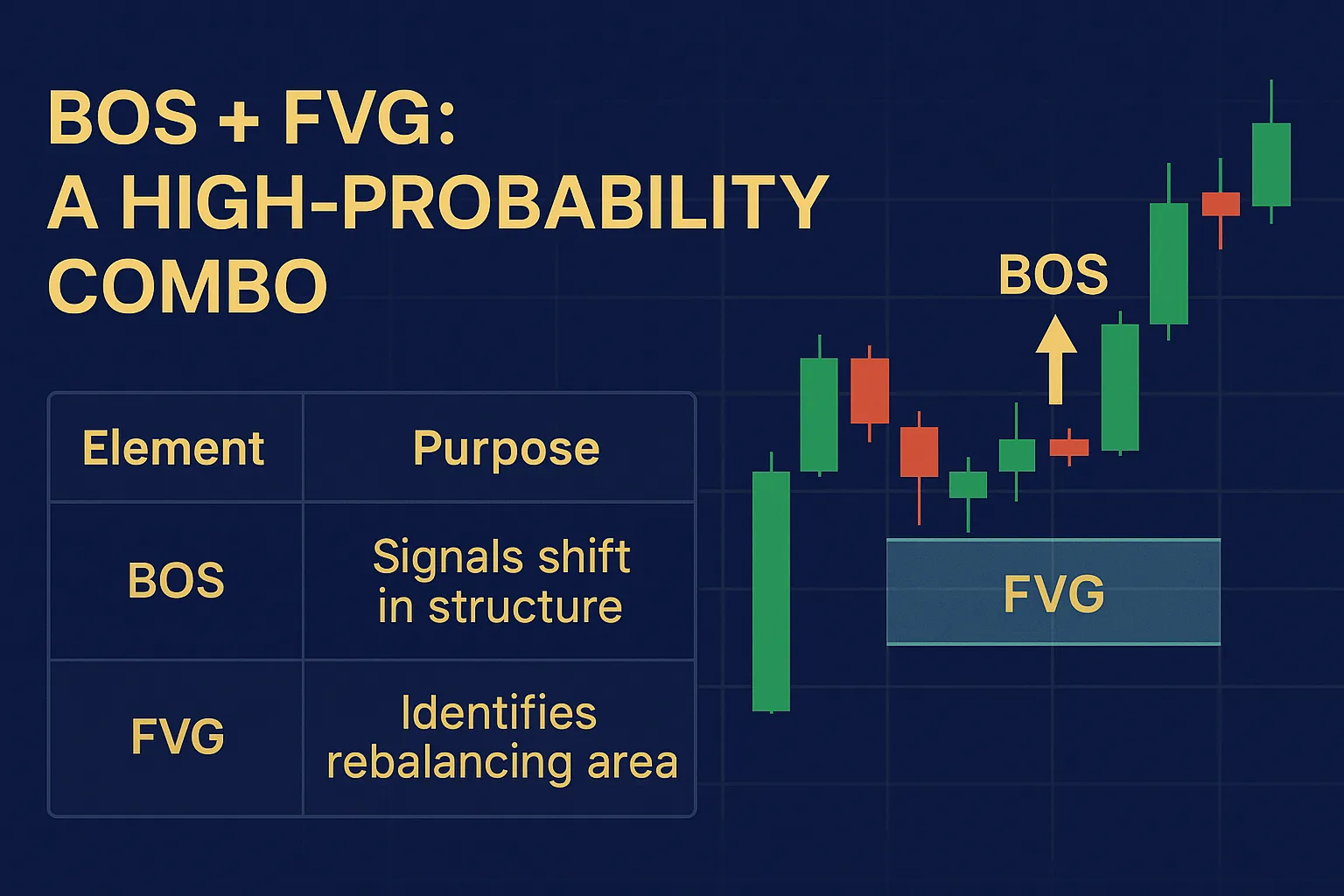

5. BOS + FVG: A High-Probability Combo

Though BOS in isolation useful, combining it with Fair Value Gaps (FVGs), dramatically enhances chances for success.

Why this combination works?

| Element | Purpose |

|---|---|

| BOS | Signals shift in structure |

| FVG | Identifies rebalancing area |

Strategy Tip: After a BOS, take the FVG from the impulsive candle. Wait for price to retrace into it, then enter, placing stops below the impulsive candle’s low and targeting liquidity zones above. This setup works well for BTC, ETH, and even layer 2 tokens like ARB and OP.

6. FAQ

What is BOS short for?

Break of Structure — a determining violation of a significant swing level that marks a potential shift in control of the market, frequently used in SMC.

Is BOS equal to CHoCH?

No. BOS indicates trend continuation; CHoCH suggests change in trend or nature.

What indicators assist in identifying BOS?

Indicators like LuxAlgo’s Smart Money Concepts indicator or barrycoder’s proprietary scripts enable structural breaks and zones of liquidity to be visualized.

Can BOS be used for scalping in DeFi?

Yes. BOS offers high-probability entries on lower timeframes with FVGs and mitigation blocks.

How do I know a BOS is valid?

Find a strong displacement candle, break of a key level, volume spikes, and confluence with FVGs or liquidity zones.

7. Final Thoughts

BOS is not merely a chart pattern; it’s a glimpse into behavior of smart money in crypto markets. Identifying genuine BOS setups — skipping fakeouts — changes your strategy from reactive to predictive. You start to predict market action ahead retail traders.

Understanding market structure in terms of BOS and CHoCH, overlaid by FVGs, liquidity zones, and order blocks, is a dynamic style that can be applied over timeframes and any token. Implement BOS as a basic utility and bring your crypto trading into the big league.

➔ Post created by Robert AI Team