Swing High & Swing Low Crypto Trading Guide

Mastering Swing Highs and Swing Lows in Crypto Trading

Whether you’re waiting for Bitcoin’s next breakout or need a perfect exit on Ethereum, swing highs and swing lows are your guide to crypto’s zany volatility. Swing points help you time entries, firm up stops, and ride trends with conviction.

Table of Contents

- What Are Swing Highs and Swing Lows?

- Spotting Swing Points on Your Charts

- On-Chain Signals That Confirm Swings

- Automating Detection with Pine Script

- Real-World Example: BTC’s Latest Range Break

- Extending Strategies to DeFi and NFTs

- Common Pitfalls and How to Dodge Them

- Key Takeaways

- Frequently Asked Questions

What Are Swing Highs and Swing Lows?

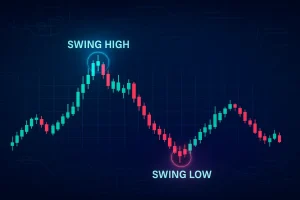

Swing highs are the highs where a trend is reversed uptrend, and swing lows are the lows where a downtrend is reversed. Finding those pivot points earlier rather than later gets you ahead—enabling you to get in when momentum is about to switch and get out before a reversal devours profits.

Spotting Swing Points on Your Charts

Price Action Basics

Use simple candlestick charts on 4-hour or daily charts. A swing high occurs when the high of a candle is above the highs of the preceding and following two candles; a swing low is the opposite. Spot these on several timeframes in an effort to observe where the significant support and resistance are.

Volume and Order-Book Clues

A volume spike at the swing high can be a sign that buyers are tapped out. A volume spike at a swing low can be a sign that sellers are tapped out. Throw in Binance order-book snaps—if there are large bids building just above a swing low, that is your buy signal for an impending bounce.

On-Chain Signals That Confirm Swings

Chart patterns tell part of the story; on-chain metrics fill in the rest. Whale transfers to exchanges often precede breaks below swing lows. DeFi TVL shifts can undercut a swing high. I’ve seen whales offload just before a major price drop—proof that the crowd moves first and price follows.

Automating Detection with Pine Script

Coding your own indicator is efficient and ensures that you will never miss a pivot. Here is a TradingView embed that can be added to any post:

// @version=5

indicator("Auto Swing High/Low", overlay=true)

swHigh = ta.pivothigh(high, 2, 2)

swLow = ta.pivotlow(low, 2, 2)

plotshape(swHigh, title="Swing High", style=shape.triangledown, location=location.abovebar, size=size.small, color=color.red)

plotshape(swLow, title="Swing Low", style=shape.triangleup, location=location.belowbar, size=size.small, color=color.green)

alertcondition(swHigh, "New Swing High", "Price printed a swing high!")

alertcondition(swLow, "New Swing Low", "Price printed a swing low!")

Real-World Example: BTC’s Latest Range Break

Bitcoin traded between $55K and $62K for weeks. I marked each swing low of $62K and swing high of $55K, then observed a whale unloading directly at the level—price declined to $52K before reversing. Traders who respected that swing low participated in the correction and picked up the bounce.

Extending Strategies to DeFi and NFTs

DeFi: Track TVL swing highs against token price. Reversal is imminent when UniSwap TVL is high while token is stagnant. NFTs: Track floor-price swings on OpenSea—rising floors on swing highs mean new collector interest, best for listing timing.

Common Pitfalls and How to Dodge Them

- Following each signal: Wait for volume or on-chain confirmation.

- Ignoring timeframe: A 15-minute swing is trivial compared to a daily pivot—size risk proportionally.

- Over-engineered scripts: Lean code reduces lags and false signals.

Key Takeaways

- Combine price action with volume and on-chain data for high-confidence pivots.

- Automate with Pine Script to catch every new swing.

- Translate swing insights to DeFi protocols and NFT markets.

- Remain disciplined: wait for confirmation and respect your timeframes.