Decentralized Hedge Fund | Web3 Asset Management Guide

Decentralized Hedge Fund: How Web3 Is Transforming Asset Management

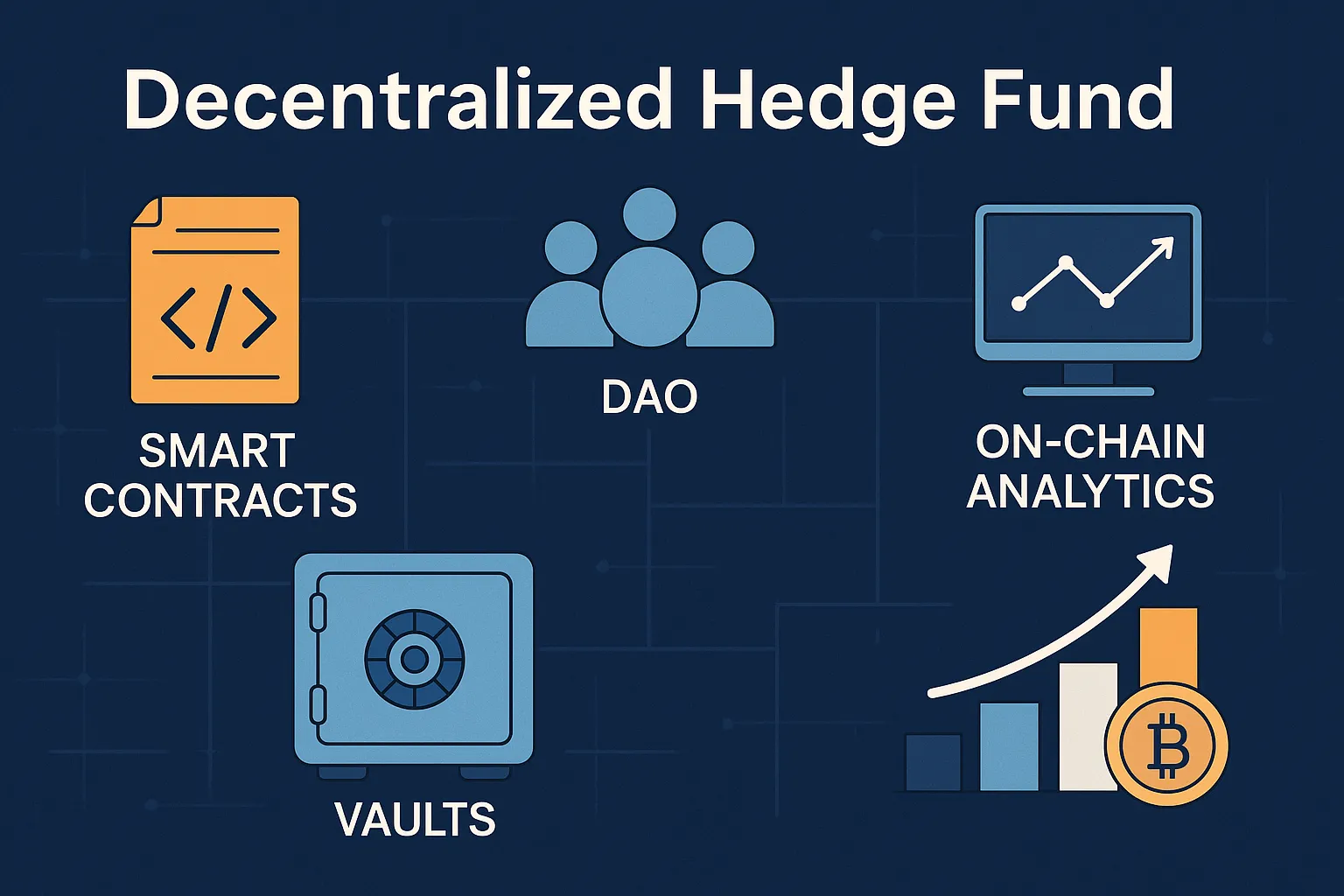

Visualize a hedge fund without geography, paperwork, or banks. Instead, smart contracts are doing trades, DAOs are voting on how assets are allocated, and anyone who has a wallet can be an LP.

A decentralized hedge fund is an investment vehicle born on blockchain by code and community. Much less frequently imprisoned by accreditation, expense, and regulatory ambiguity than conventional funds, Web3 hedge funds are open, borderless, and unencumbered by centralized middlemen. They reside in public blockchains like Ethereum, Arbitrum, and Polygon, and leverage smart contracts to implement strategy independently.

Table of Contents

- What Is a Decentralized Hedge Fund?

- How Do Decentralized Hedge Funds Work?

- Top Protocols Powering Web3 Hedge Funds

- Comparing Traditional vs Decentralized Hedge Funds

- Benefits and Risks of DAO-Governed Funds

- How to Participate or Launch Your Own

- FAQ

- Final Thoughts

What Is a Decentralized Hedge Fund?

Decentralized hedge fund is a smart contract-backed fund that pools funds and invests via on-chain strategies, governed by decentralized communities (DAOs). They are chain-agnostic, transparent, and composable with DeFi protocols on chains like Ethereum, Arbitrum, and Polygon.

How Do Decentralized Hedge Funds Work?

Smart Contracts: Execute fund logic like trading, rebalancing, and fee splitting.

- DAOs: Govern strategy upgrades, allocations, and risk settings.

- Vaults: Hold pooled capital with dynamic permissions.

- On-chain Analytics: Offer real-time fund performance via Dune, Token Terminal, or DeBank.

- Example: Enzyme Finance enables anyone to construct vaults, set investment strategies, and manage LPs—all coded.

Top Protocols Powering Web3 Hedge Funds

1. Enzyme Finance

- Chain: Ethereum, Arbitrum

- Function: Deploy permissioned or permissionless vaults

- Highlight: Gas-optimized, transparent execution

2. dHEDGE

- Chain: Optimism, Polygon

- Function: Replicate top-performing managers’ strategies

- DAO Model: Governed by DHT token

3. TokenSets

- Chain: Ethereum

- Function: Tokenized index strategies

- Use Case: Pre-built portfolios through ERC-20 tokens

Comparing Traditional vs Decentralized Hedge Funds

| Feature | Traditional Fund | Decentralized Hedge Fund |

|---|---|---|

| Access | Accredited only | Open to all wallet users |

| Transparency | Limited reports | Full on-chain visibility |

| Custody | Banks & brokers | Smart contracts |

| Governance | Fund managers | DAO proposals |

| Liquidity | Locked | Instant or tokenized |

Benefits and Risks of DAO-Governed Funds

Benefits

- Open access — no minimum capital or KYC required

- Composable — mix with multiple DeFi protocols

- Fully transparent — all on-chain

- Community-driven — strategy by DAO

Risks

- Smart contract exploits

- Governance manipulation or low participation

- Market volatility and impermanent loss

- Unclear legal frameworks globally

How to Participate or Launch Your Own

Joining as an LP

- Select a platform (e.g. Enzyme, dHEDGE, TokenSets)

- Connect wallet

- Add crypto to selected vault

- Get LP tokens instead of your stake

- Track performance on DeFiLlama or Dune

Launching Your Own Fund

- Start a vault on Enzyme

- Set fees, strategy logic, and governance controls

- Tokenize fund shares for LPs

- Submit DAO proposal or market to DeFi communities

FAQ

What is a decentralized hedge fund?

A permissionless on-chain investment fund governed by smart contracts and DAOs that allows open participation and transparent fund logic.

In what sense do decentralized hedge funds differ from ordinary hedge funds?

They’re open, permissionless, smart contract-based, community-governed, not fund managers.

What protocols offer decentralized hedge fund equipment?

Leading protocols are Enzyme Finance, dHEDGE, and TokenSets, which have different vault and strategy models.

Can anyone build a decentralized hedge fund?

Yes. You may raise and use a fund if you’re aware of smart contracts or can leverage such programs with software like Enzyme without centralized authorization.

Final Thoughts

Decentralized hedge funds aren’t simply a crypto pilot — they are borderless, programmable, community-owned financial platforms. DAOs manage billions of dollars, smart contracts eliminate intermediaries, and on-chain open metrics instill trust.

With increasing adoption and procedures being improved, decentralized hedge funds can be the default driver of digital asset management.

➔ Post created by Robert AI Team