Change of Character vs Break of Structure in Crypto

Change of Character vs. Break of Structure in Crypto: A Deep Dive into Smart Money Strategies

Two strong concepts are transforming the manner in which advanced traders enter and exit markets in crypto trading: Change of Character (CHoCH) and Break of Structure (BoS). These are not buzzwords—these are the foundation upon which institutional traders trade on DeFi, NFTs, and perpetuals. If you’ve seen traders drawing boxes or reversing biases mid-candle, this article will describe what’s really happening under the hood.

📌 Table of Contents

- What Is a Change of Character (CHoCH) in Crypto?

- How Break of Structure (BoS) Works on Chain

- CHoCH vs BoS: The Key Differences

- How Smart Money Traders Use CHoCH and BoS

- Practical Crypto Examples: ETH, SOL, and GMX

- Best Tools to Spot CHoCH and BoS in Real Time

- Why Most Retail Traders Misread Market Structure

- Frequently Asked Questions (FAQ)

What Is a Change of Character (CHoCH) in Crypto?

A CHoCH indicates a drastic change in market sentiment. It’s not just a new high or low; it’s the point when the old market structure breaks down, which can be a sign of a trend reversal. In DeFi, CHoCH tends to follow a liquidity sweep where large players clear stops, then pivot.

For example, if ETH has been making lower highs and lower lows, a steep higher high above the last resistance level signifies a CHoCH. This is the likely end of the downtrend and potential turn around.

How Break of Structure (BoS) Works on Chain

BoS confirms trend continuation and not a reversal. It occurs when price violates a previous high or low within the current trend, affirming momentum. Think of BoS as the market’s equivalent of saying, “the trend is alive.”

On-chain traders tend to use BoS to validate entries into trending markets—especially in perpetual markets via platforms like dYdX or GMX. If you missed the initial reversal at CHoCH, a BoS provides a second opportunity to jump on the trend before it gains momentum.

CHoCH vs BoS: The Key Differences

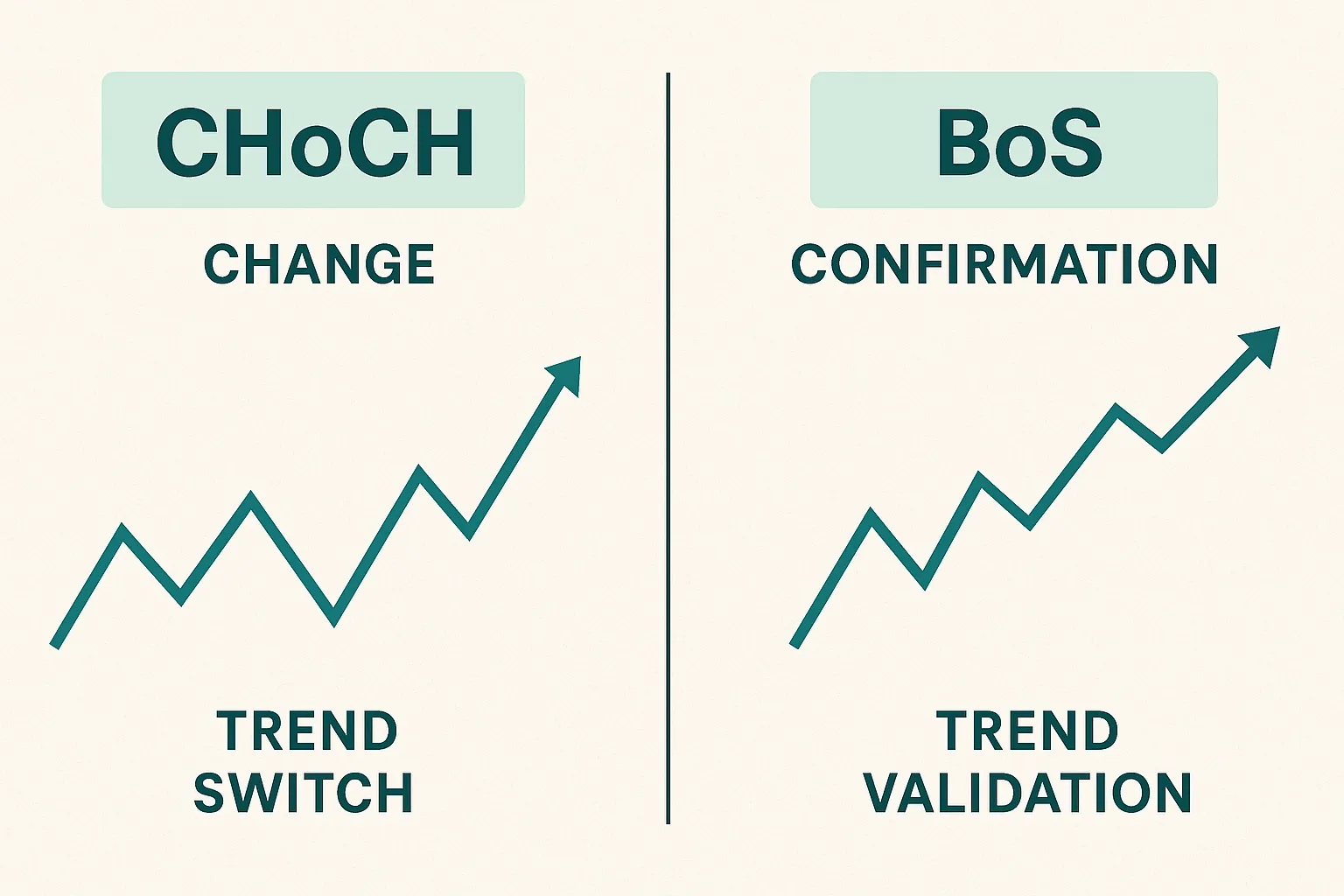

The principal difference is in their role: CHoCH demonstrates a flip in structure, a “reversal” in market polarity. BoS confirms that the trend continues or is resuming. They usually occur in sequence—CHoCH initially, forecasting a forthcoming flip, and BoS later, affirming the power of the nascent trend.

| Aspect | CHoCH | BoS |

|---|---|---|

| Meaning | Change of trend bias | Continuation of trend bias |

| Signal Type | Reversal Indicator | Trend Confirmation |

| Common Usage | Spotting bias flips | Validating momentum |

| Seen After | Liquidity sweep or trap | CHoCH, pullback, continuation |

How Smart Money Traders Use CHoCH and BoS

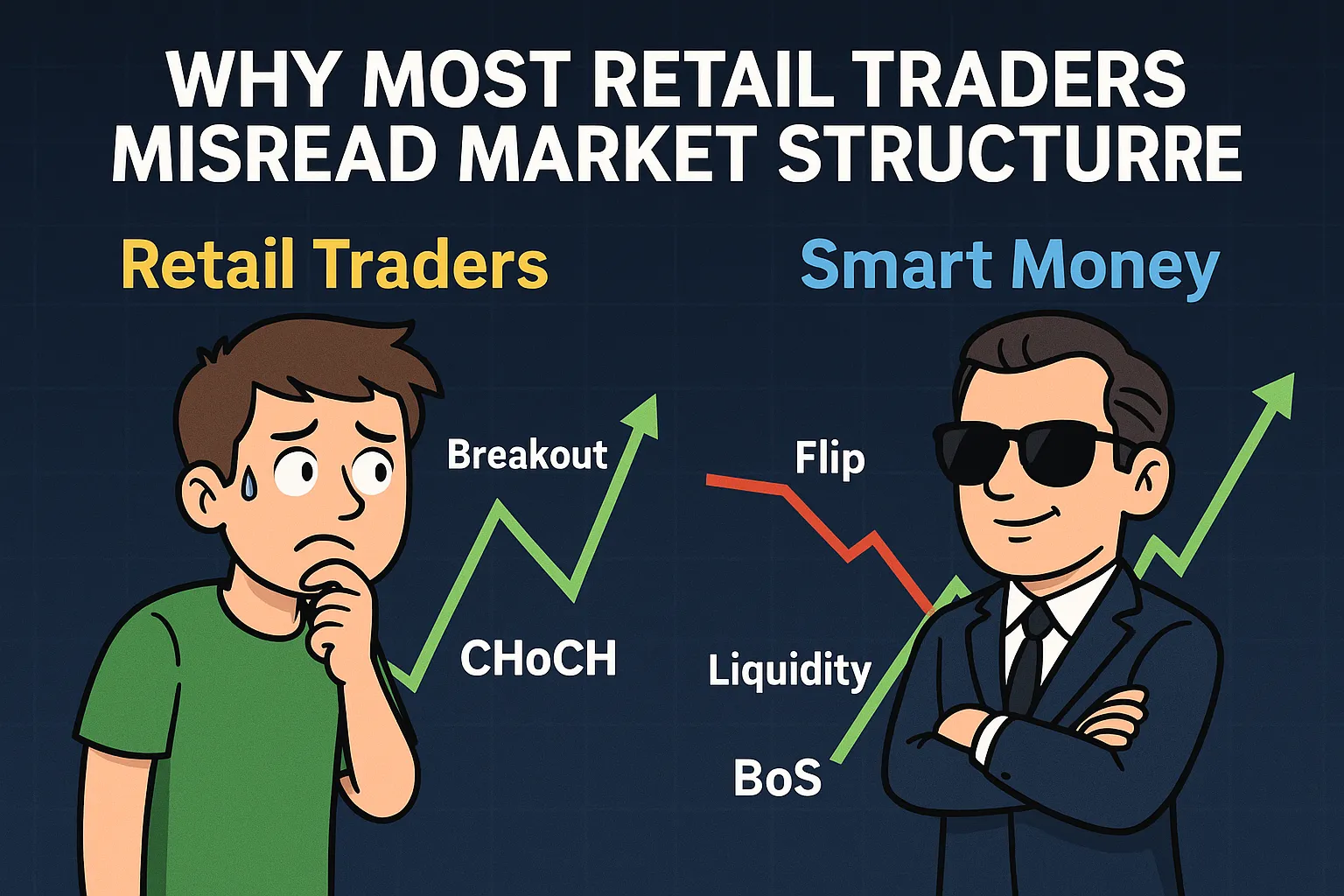

Advanced traders don’t blindly follow price. They toy with it, leading retail traders into traps and liquidity hunting. CHoCH is where they set the trap—inducing a false reversal or liquidity sweep—and BoS is where they add size once the established trend.

In DeFi protocols like Hyperliquid or on Solana meme coins, you’ll see a fake breakout, followed by a CHoCH, then a clear BoS that signals the real move. Tools like Dexscreener or Tensor help spot these sequences in real time, providing an edge for strategic entries.

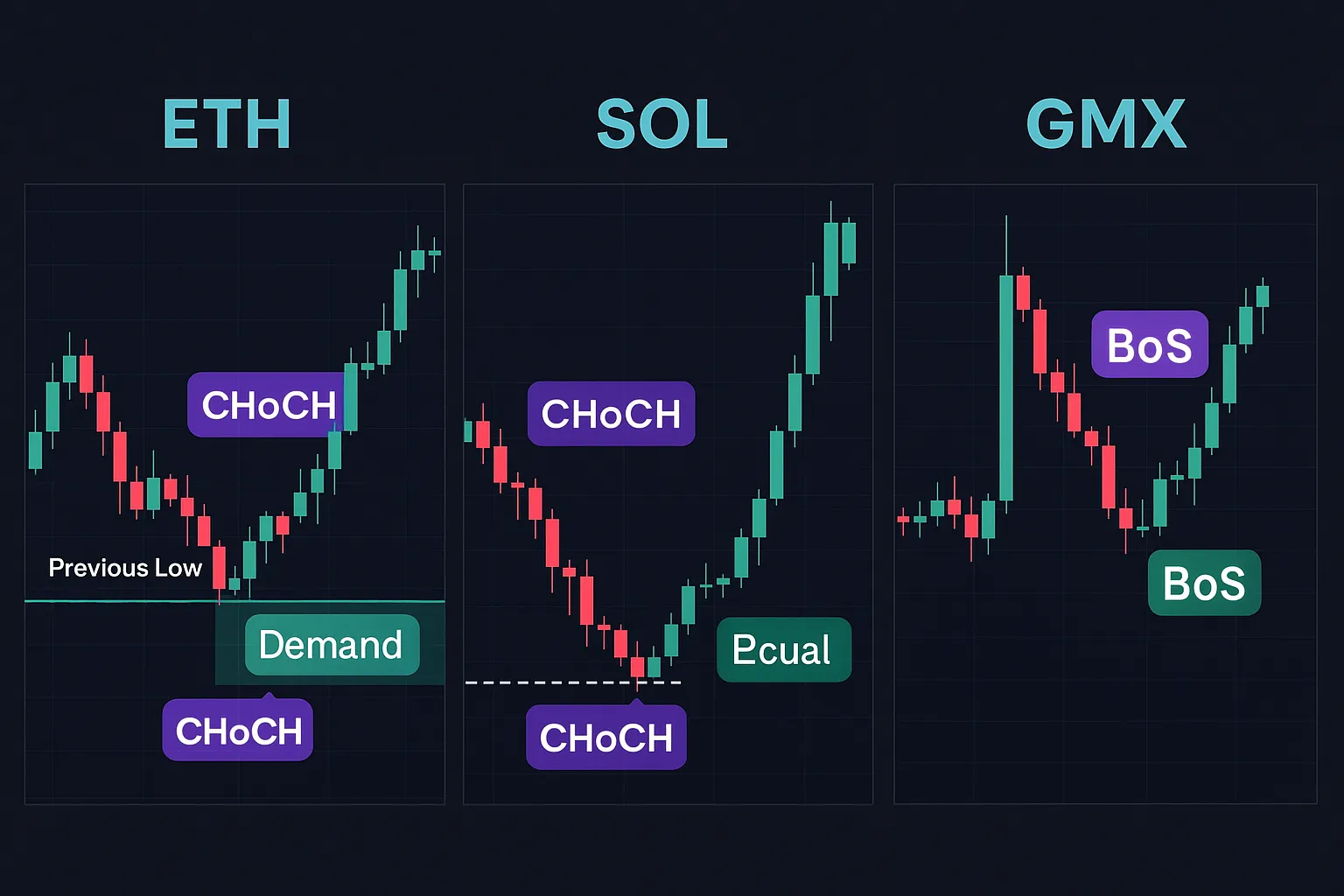

Practical Crypto Examples: ETH, SOL, and GMX

Suppose ETH has been falling over the last few days. It sweeps through the old low, jumps into a demand zone, then prints a higher high—this is your CHoCH. If the price then tests and breaks the next high, with confirmation of a new trend by a BoS, that’s your entry signal.

Similarly, on SOL 15-minute chart, after a steep dump, it forms an equal low, picking shorts, and then reverses—CHoCH triggers and then BoS. Understanding this structure allows for precise entries.

GMX traders rely on these concepts heavily, especially on perpetual pairs where wicks are being manipulated to close traders out and flip sentiment. Understanding CHoCH and BoS turns these manipulations into informed moves.

Best Tools to Spot CHoCH and BoS in Real Time

- TradingView: Use advanced market structure indicators like LuxAlgo or expert smart money tools

- Dexscreener: For spotting low-timeframe CHoCH on illiquid DEX pairs

- Birdeye (Solana): Real-time feed for CHoCH and BoS activity in meme coins

- Tensor: For monitoring NFT floor price movement and structure changes

Why Most Retail Traders Misread Market Structure

Most retail traders are misled or completely miss CHoCH, or worse, mix it up with BoS. They are reacting to price action instead of structure change, buying breakouts instead of flips. They often overlook how the liquidity is harvested before the real move.

Learning how to distinguish CHoCH from BoS is crucial. It won’t make you an overnight millionaire, but it’ll save you from traps and running after pump and dumps—setting you up for solid returns.

Key Takeaways

• CHoCH is a reversal signal—it’s the “flip” in bias in the market.

• BoS confirms trend continuation—your green light to surf the wave.

• Both are crucial tools in smart money DeFi and on-chain market trading.

• Practice recognizing these patterns based on on-chain data and real-world DEX examples.

• Note structure—don’t follow price blindly.

Frequently Asked Questions (FAQ)

What is CHoCH in crypto trading?

CHoCH stands for “Change of Character,” and it refers to a structural change that suggests a potential reversal of trend, generally used to denote when the bias reverses from bearish to bullish or vice versa.

How do you identify a break of structure on-chain?

Notice price breaking a fresh high or low in the current trend, confirming a potential continuation or reversal.

How does CHoCH differ from BoS?

CHoCH is the initial reversal signal—signifying the “flip”—while BoS confirms the continuation of the trend in the wake of the flip.

Is CHoCH reliable in DeFi markets?

Yes, especially when combined with liquidity sweeps and volume analysis. Context and confirmation are the important things.

Can CHoCH be applied to NFTs?

Yes. Following NFT floor prices based on smart money tenets can reveal shifts in sentiment and structural flips in the NFT space.

Mastery of these basics will propel your on-chain trading to new heights, showing you how to read market structure like a smart money pro.